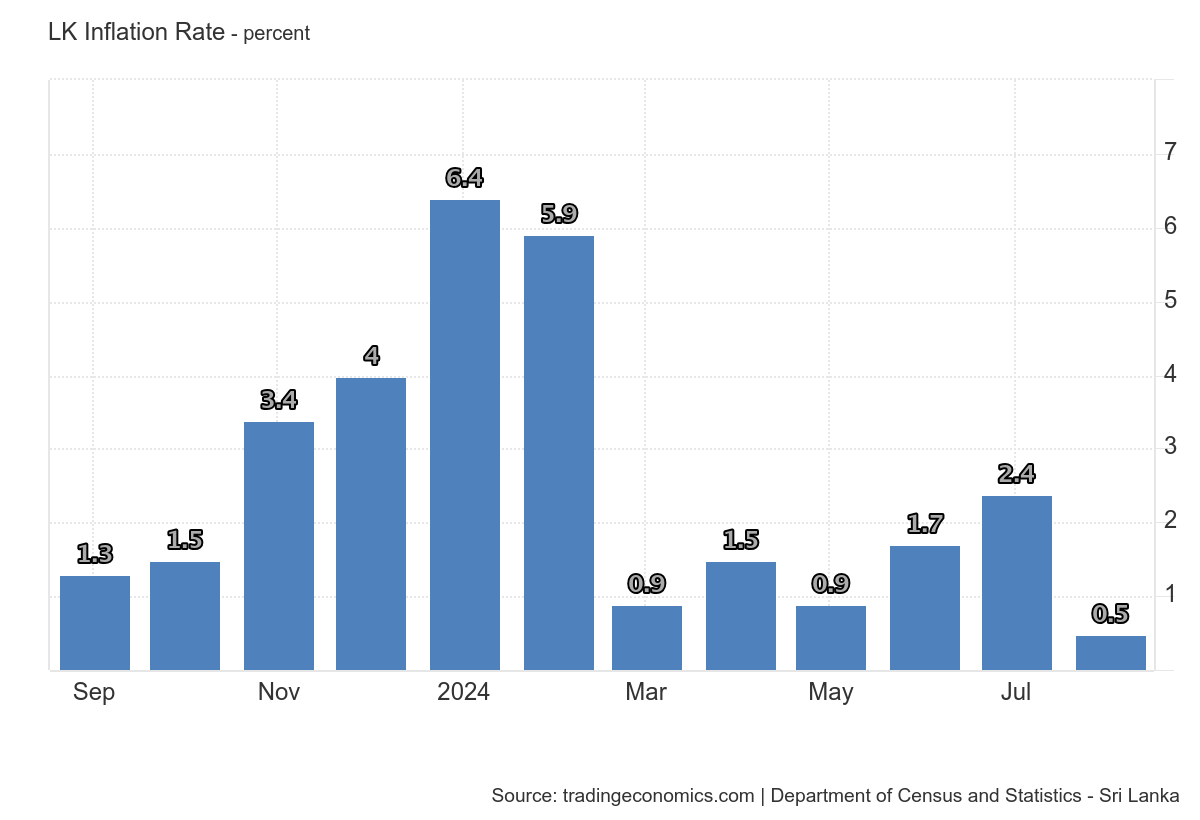

Sri Lanka’s inflation rate dropped to 0.5% in August 2024, marking a significant improvement in economic stability. Discover the factors behind this decline, its impact on the economy, and future projections in our detailed analysis

The Sri Lankan economy has experienced a period of instability in the past years characterized by rapid inflation, economic crisis, and policy uncertainty. However, in August 2024, the country unearthed some glimmers of hope as the headline inflation rate was surprisingly low at 0.5%, which was a steep drop from the value of 2.4% just a month earlier. This article examines the issues that fueled the drop in inflation, the consequences for the Sri Lankan economy, and the potential outlook.

Understanding Inflation and Its Impact on the Economy

Inflation is a measure of how the general price level of commodities and services within an economy grows over time. Low rate of inflation is considered a positive sign of a growing economy, but the price of consumer goods would decrease. High inflation, on the other hand, causes the buying power of a consumer to go down, so that it is necessary for him to pay more when purchasing everyday may be cheap necessities. Over time, Sri Lanka has moved from inflation to turbulence, with rates regularly going up or down.

Sri Lanka’s Inflation Journey: A Historical Overview

In 2022, the Sri Lankan economy went through one of the worst periods due to the fact that prices soared so high that the rate of inflation reached a staggering 69.8% in September, which made the country facing serious economic crisis in the whole of South Asia. This economic turmoil was marked by massive shortages of food, fuel, and necessary goods, which in turn resulted in general disorder and economic instability. Ever since, the South Asian country has picked itself, slowly eliminating high inflation although it is still wobbly.

August 2024: A Month of Change

As of August 2024, Sri Lanka’s economic growth goal got a boost as the headline inflation rate came down to 0.5%. This has come as a sudden drop from the previous 2.4% inflation rate that was recorded in July. According to the Colombo Consumer Price Index (CCPI), almost all categories including food and non-food have gotten cheaper, which was the main contributor to the decrease in inflation. The cost of food category inflation reduced to 0.8% in August from 1.5% in July which meant a 0.7% fall in the food category, whereas non-food price inflation decreased to 0.4% from 2.8% etc.

Factors Contributing to the Drop in Inflation

A few causes were recognized as the main drivers for the sharp fall in inflation in the month of August. The most important one was the decrease in prices in the food and non-food sectors. The effort of the government to stabilize the economy, along with the focused policies to control the prices of goods and the development of affordable and easy supply chains, played a crucial role in this good development.

The Role of Electricity Costs in Reducing Inflation

One of the most notable factors that led to the decline in the inflation rate was the significant reduction in electricity costs. In the month of July, the prices of electricity dropped by 22.5%, which had the effect of reducing the overall inflation rate in August. In addition, lower energy prices decrease the price of production and transportation, and result in cheaper commodities to be transferred all across the economy.

The Central Bank’s Projections and Policies

For some time now, the Central Bank of Sri Lanka has been keeping a close eye on the trends of inflation rates and implementing certain measures that are intended to help stabilize the national economy. Therefore, the Central Bank projected in its recent report that the headline inflation rate would remain below 5% as long as the current policies are maintained which was the case. This result was in favor of the unfolding significant decrease in inflation in August.

press_20240830_inflation_in_august_2024_ccpi_eThe Impact of Global Economic Conditions

Sri Lanka’s economy is not isolated from global economic trends. Fluctuations in global oil prices, changes in international trade policies, and shifts in global demand have had a direct impact on the country’s inflation rate. Over the past few months, we have seen signs of stability in the world market, which has consequently lowered inflationary pressure in Sri Lanka.

Consumer Behavior and Market Demand

Consumer behavior is the main factor behind inflation rates. In Sri Lanka in August 2024, market demand was low because of the political uncertainties and the abstemiousness of the consumers due to the upcoming presidential election. It was this slowed demand that caused no further increase in prices as the firms were not able to pass them on to the consumers in a market with very few activities.

The Presidential Election and Its Economic Implications

Uncertainty in the political environment usually significantly affects economic conditions and Sri Lanka is not the exemption. As the scheduled presidential election is less than a month away (21st of September 2024), a lot of businesses and customers have adopted the wait-and-see approach, which means they have been postponing the big expenditure and investment decisions. This pull back in the market, due to uncertain conditions, has consequently led to the reduction of inflation.

Sri Lanka’s Recovery from the Financial Crisis

2022 the economic crisis was a deciding point for Sri Lanka, which was in an upsurge with the inflation rate, the fall of the local currency and a lot of the vital goods deficits. The incumbent government has since introduced a range of reforms aimed at stabilizing the situation. The country is thus slowly emerging due to these interventions in combination with the help of the international community, at the same time, firming up and consequently keeping under control inflation rates.

The Role of the IMF Bailout in Economic Stabilization

One of the key factors contributing to the economic growth in Sri Lanka is the $2.9 billion funded by the International Monetary Fund (IMF) in March 2023. This assistance played a critical part in the reduction of the country\xe2\x80\x99s financial stability, thus giving the government the required capacity to carry out the changing policies and to master the surge in inflation. The IMF\x91s assistance has been of total significance in aiding Sri Lanka to come out of the economic downturn.

Future Economic Outlook for Sri Lanka

By the year 2024, the Central Bank predicts that the economy of Sri Lanka will grow by 3%, having got the 2.3% shrinkage in 2023. Although the recent decline in inflation is a good sign, the country still faces certain issues, namely political uncertainty, external debt pressures, and structural reforms. In fact, if the current policies are rigorously kept and the external conditions remain favorable, there is surely a chance for the country to relegate on its usual path of sustainable economic growth in the next few years.

Key Sectors Affected by Inflation Changes

The economy of the country is one such decisive factor that tells us how the inflation rate affects different sectors. In fact, the inflation trend in the Sri Lankan economy has had a profounder impact on mostly agriculture, manufacturing, and retail than some foreign counterparts that experienced a negative impact. We can say that short-run increases in inflation are probably more commonly associated with these industries. Nonetheless, other challenges like disruption of supply chains and lack of labor may threaten production.

Public Perception and Reaction to Inflation Trends

The public in Sri Lanka has reacted in different ways to the drop in inflation in August; those who now have a high sense of relief traditionally lived with that fact. They felt a kind of sense of comfort as the price decrease is a good sign, but, on the other hand, many citizens still have some fears about possible future price hikes particularly due to the political certainty. The public can bifurcate the policies of the government as it appears to be pro. However, the populace keeps on stressing the effectiveness of the economic policies, peace, and development.

Conclusion and Key Takeaways

The sharp decrease in the inflation rate of Sri Lanka to 0.5% in August 2024 is a positive sign for the country’s economy. This reflects the successful policies adopted by the government, the positive impact of the reductions in energy prices, and the international economic situation. Despite these reasons, it cannot be ignored that the future of the economy will also depend on the lasting stability of inflation and the continued effort to reinforce the economy’s infrastructure and mechanics. As the country progressively marches on, it becomes a necessity to build the entire nation in a green and clean way, with no disarray, and set apart the politics of unity.

FAQs

What led to the significant drop in Sri Lanka’s inflation rate in August 2024?

The drop in inflation was primarily driven by decreases in both food and non-food category prices, as well as a significant reduction in electricity costs.

How does inflation impact everyday life in Sri Lanka?

High inflation erodes purchasing power, making it more expensive for consumers to buy essential goods and services, thereby affecting their standard of living.

What role did the Central Bank play in controlling inflation?

The Central Bank implemented policies aimed at stabilizing the economy and managing inflation, contributing to the recent drop in the inflation rate.

Will Sri Lanka’s inflation rate continue to drop in the coming months?

According to the Central Bank’s projections, inflation is expected to remain below the target of 5% in the coming months, provided that current policies are maintained.

How has the IMF bailout affected Sri Lanka’s economy?

The $2.9 billion IMF bailout provided crucial financial assistance that helped stabilize Sri Lanka’s finances, enabling the government to implement necessary reforms and manage inflation.